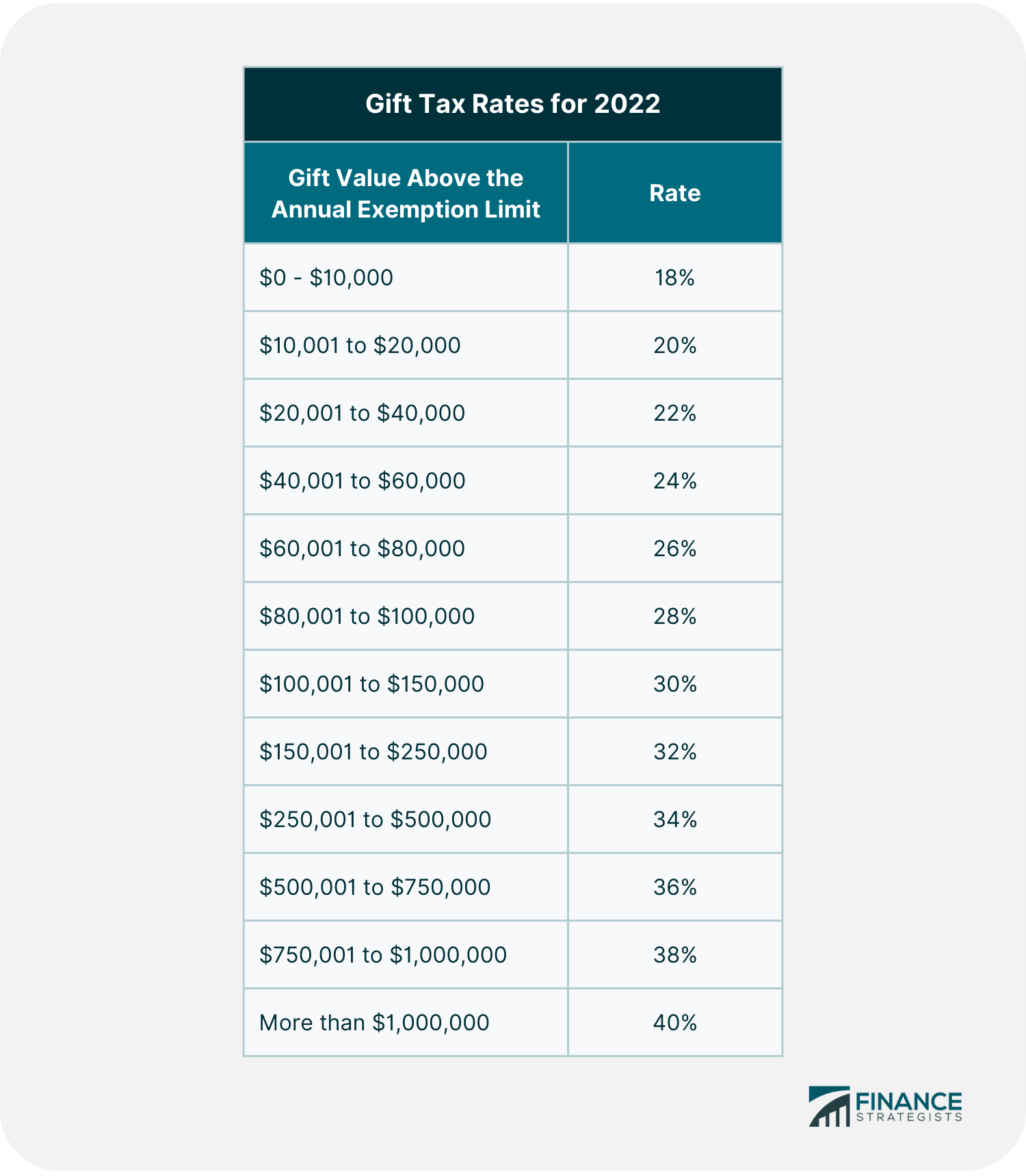

2025 Gift Limits. In other words, giving more than $19,000 to any individual in 2025 means you. The irs recently announced increases in gift and estate tax exemptions for 2025.

This generally means that an estate of a decedent who dies in. The annual gift tax exclusion will rise to $19,000 per recipient, up $1,000 from the 2024.

Gift Tax 2025 Limit 2025 Zoe Lyman, The irs has revealed that, starting in 2025, inflation adjustments will bring significant increases to the annual gift tax exclusion and the lifetime estate and gift tax.

Gift Tax 2025 Limit Adam Vaughan, As we approach 2025, changes in gift and estate tax exemption limits are expected to impact how individuals and families transfer wealth.

IRS Gift Limits From Foreign Persons 2025, The irs has revealed that, starting in 2025, inflation adjustments will bring significant increases to the annual gift tax exclusion and the lifetime estate and gift tax.

2025 Gift Tax Limit Angele Mildrid, For the calendar year 2025, the annual gift tax exclusion will increase to $19,000 per recipient, up from $18,000 in 2024.

2025 Gift Limits To Children Doe Perrine, The annual gift tax exclusion will rise to $19,000 per recipient, up $1,000 from the 2024.

Irs Gifting Limits 2025 Lela Loretta, In addition, gifts from certain relatives such as parents, spouse and siblings are also exempt from tax.

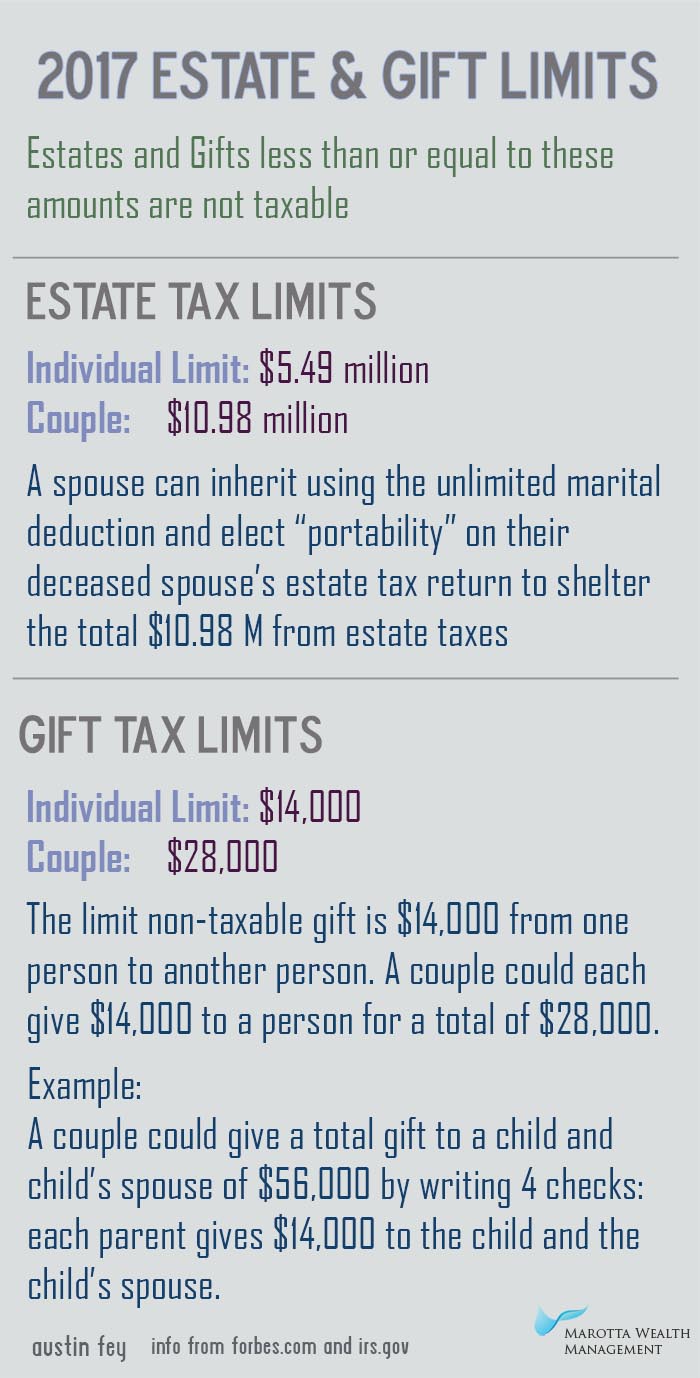

2025 Gift Tax Limit For Individuals Hadria Analiese, What are the 2025 estate tax and gift tax limits?